OIG Report: Untimely Beneficiary Self-Reporting Major Cause for SSA Overpayments

FOR IMMEDIATE RELEASE

March 21, 2025

Media Inquiries: oig.press@ssa.gov

The Social Security Administration’s (SSA) documented causes for issuing overpayments in its two payment programs. SSA OIG issued an informational report on Feb 20, 2025, that indicates that the largest cause to overpayments I beneficiaries untimely reporting of information that affected their benefits. The report reviewed the Old-Age, Survivors, and Disability Insurance (OASDI) and Supplemental Security Income (SSI) overpayments in Fiscal Years 2020 through 2023.

SSA has limited access to automated real-time information required to determine beneficiaries’ eligibility and payment amounts. Instead, SSA depends on beneficiaries, representative payees, or family members to timely provide the information. Or SSA receives this information, after the fact, from other sources.

Without more automated data feeds, SSA will continue to require resources for assessing and pursuing the recovery of billions of dollars in overpayments. This places a burden on SSA by requiring employees to spend valuable time on these processes versus focusing on other workloads. It further places a burden on beneficiaries who must determine how to pay back the overpayments.

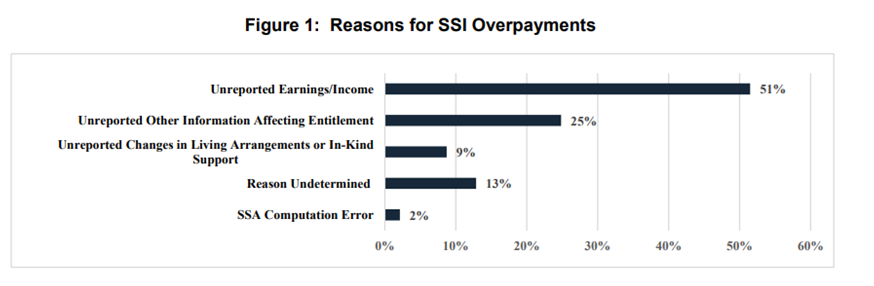

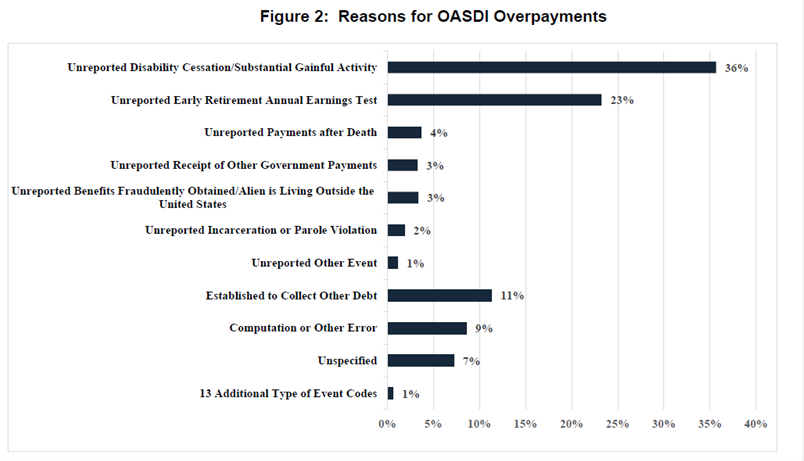

The top reasons vary per program. For instance, for SSI payments the causes were unreported earnings or income and unreported information affecting entitlement. Whereas for OASDI benefits, the top reasons were unreported disability cessation (or substantial earnings of disability claimants) and unreported early retirement annual earnings.

The following tables show the reasons for overpayments.

As summarized on Figure 1, SSA attributed 85 percent of SSI overpayments to recipients who did not timely report information that affected the amount of SSI payments they were eligible to receive. SSA attributed the remaining 15 percent to reason undetermined or computation errors.

As summarized on Figure 2, SSA attributed 72 percent of OASDI overpayments to beneficiaries who did not report or timely report information to SSA that negatively affected their benefits. SSA determined the remaining 28 percent occurred due to other reasons.

Read the full report here.

Read a PDF of the press release here.